Basis trade

Basis Trade in Crypto: Earn Yield with Delta-Neutral Strategies — And Why DEXes Can Outshine CEXes

In the crypto world, you don’t always need to gamble on whether a token’s price will go up or down. A powerful alternative is the basis trade: a market-neutral strategy that lets you earn yield by exploiting the difference between the spot price and the perpetual futures (perp) price of a token.

Traditionally, people talked about doing this on centralized exchanges (CEXes) like Binance or Bybit, because they had deep liquidity and low slippage. But the landscape is changing. On some decentralized exchanges (DEXes), like Drift on Solana, GMX on Arbitrum or Hyperliquid, you can often find lower fees and higher, more sustained funding rates — particularly for Ecosystem-native tokens where community enthusiasm is strong.

1. What is a Basis Trade?

The “basis” is the gap between the spot price (the actual price of the token if you buy it directly) and the perpetual futures price (the price of a contract that tracks the token without an expiration date).

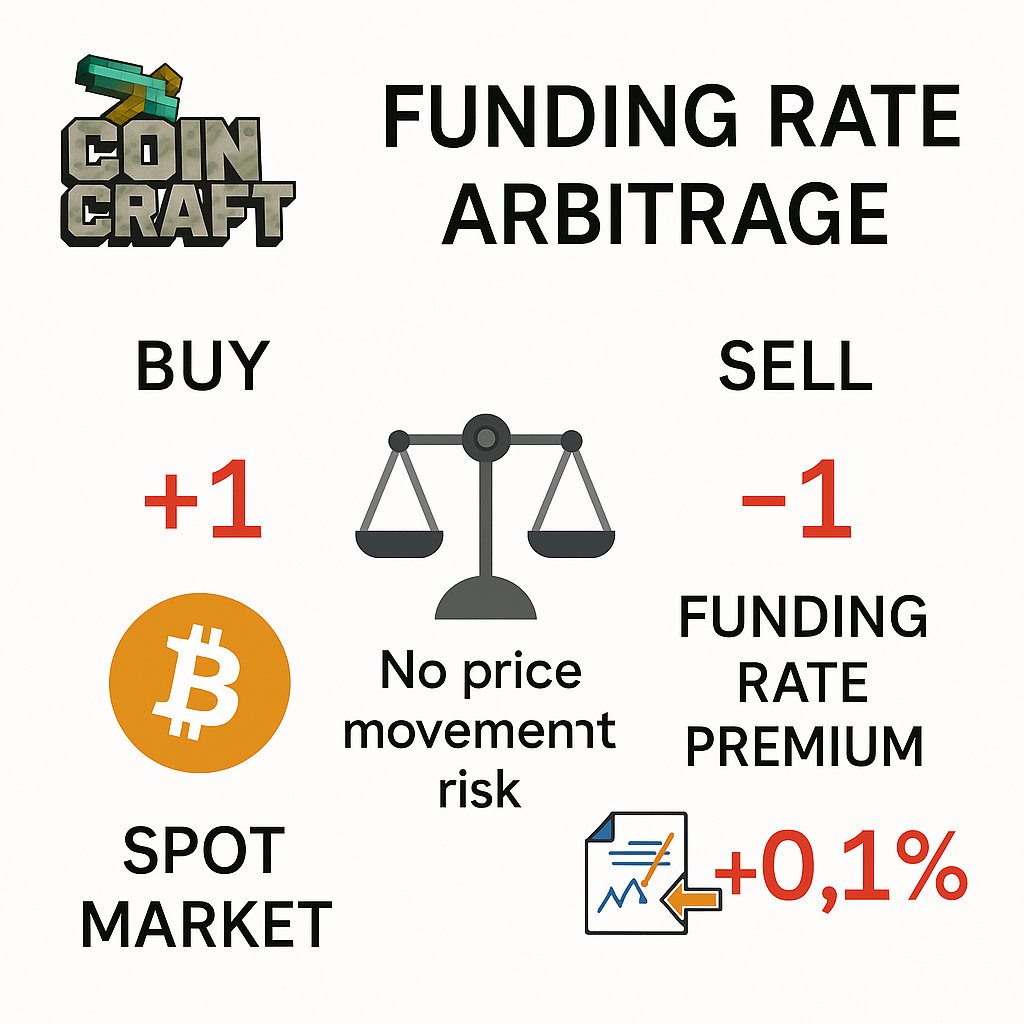

The strategy works like this:

- Buy the token on the spot market.

- Open a short position of the same size on the perp market.

- This makes you delta-neutral: if the token goes up, your spot gains but your short loses the same amount, and vice versa.

- You earn money from the funding payments, which are fees paid by one side of the perp market to the other.

2. How the Funding Rate Mechanism Works

Perpetual futures don’t expire, so exchanges use funding rates to keep perp prices close to the real spot price.

- If the perp price is above the spot price, the funding rate is positive. Long traders (betting on higher prices) pay shorts, so shorts earn money.

- If the perp price is below the spot price, the funding rate is negative. Shorts pay longs, so longs earn money.

Funding is usually paid every 8 hours on CEXes, and sometimes continuously or hourly on DEXes.

Example:

- A Solana token trades at $100 on spot.

- On a DEX like Drift, the perp trades at $102.

- That 2% premium indicates strong long demand. The exchange sets a funding rate of, say, 0.15% every 8 hours.

- If you short $10,000 worth of that token on perps, you collect around $15 every 8 hours. Over a year, if rates stay high, that can exceed 100% APR — something rarely seen on CEXes.

3. The Role of Open Interest and Your Impact

Open interest (OI) is the total value of open perp positions. It matters because it shows how crowded the market is.

- High OI with strong long pressure → funding stays positive and stable.

- Low OI with high funding → even a single big short can reduce or flip the funding rate.

Example:

If a token has only $5M in open interest and you short $1M, you just added 20% of the total. This could suddenly bring down the funding rate you were hoping to farm. In contrast, entering a small position in a market with $200M OI won’t move the needle much.

4. Spot vs Perp Premium: A Hidden Bonus

When funding rates are high, perps trade above spot. That difference itself can be a profit opportunity:

- Entering: You buy on spot cheaper (e.g., $100) and short on perp more expensively (e.g., $102). You’ve already locked in a $2 premium per token, plus you will collect ongoing funding fees.

- Exiting: If the perp is still above spot when you close, you can use limit orders to capture even more of the spread.

This extra layer of profit is what makes basis trading especially attractive on DEXes where altcoin perps can remain overheated for longer.

5. Slippage: CEXes vs DEXes

Slippage means paying a slightly worse price than expected when your order eats into available liquidity.

- On CEXes (like Binance, Bybit, OKX), order books are very deep. A $100,000 order might only move the price by a few dollars.

- On DEXes smaller liquidity pools can cause heavy slippage. A $100,000 swap in a low-liquidity pool could push the price by 0.5–1%, eating your funding profits.

- On modern Solana DEXes such as Drift, things are different: thanks to fast block times and Just-In-Time (JIT) liquidity, slippage can be much lower, often close to CEX levels, while still giving you access to higher-yielding tokens.

This means that with the right DEX and token, you might actually get both lower costs and higher funding rewards compared to CEXes.

6. Fee Structures

Let’s compare typical costs:

- Centralized Exchanges (CEXes):

• Spot trades: ~0.1% fee per side (lower with VIP levels or native token discounts).

• Perp trades: ~0.02% (maker) to ~0.05% (taker).

• Funding: varies, usually ~0.01–0.05% every 8h for BTC/ETH, sometimes higher for smaller coins. - Decentralized Exchanges (DEXes, e.g., Drift on Solana):

• Futures taker fee: ~0.03–0.10%

• Maker fee: sometimes negative (rebates like –0.0035%).

• Spot swaps: 0.05–0.3%, but on Solana, gas fees are near zero (unlike Ethereum).

• Funding: can be much higher and often more persistent, especially on Solana-native assets where community demand is strong.

Bottom line: CEXes are usually cheaper for majors like BTC and ETH. DEXes can offer better economics for altcoins, with higher funding yields and competitive or even lower net fees, especially on efficient chains like Solana.

7. Limit vs Market Orders in Basis Trading

Your entry and exit method affects your profitability:

- Market orders:

• Fast, guaranteed execution (good when a funding payment is about to occur).

• You pay taker fees and may face slippage. - Limit orders:

• Lower fees, sometimes rebates.

• You can open a perp short at a higher price or buy spot at a better price, capturing extra spread.

• But your order may never fill, and you could miss the funding window.

Example:

If SOL trades at $100 on spot and $103 on Drift perps with a high positive funding rate, you can:

- Market short at $103 immediately to ensure you collect the funding.

- Or place a limit short at $103.5 to try to lock in extra spread — but risk not getting filled if the perp never trades that high again.

8. Risks and Advantages

Main risks:

- Funding rate can flip negative.

- Your own large position might reduce the FR if OI is small.

- Smart contract risk on DEXes (bugs, exploits).

- Exchange risk on CEXes (custody, insolvency).

- Slippage or missed fills with limit orders.

Advantages:

- Market-neutral (no need to predict price direction).

- Potential for double- or triple-digit APR on less liquid tokens (common on Solana perps like on Drift).

- DEX advantage: lower fees, near-zero gas on Solana, and access to tokens not listed on CEXes.

- CEX advantage: deep liquidity and very low slippage on majors like BTC/ETH.

- Strategy is scalable depending on risk tolerance and liquidity.

8. Perfect Scenario

- Both positions opened by limit orders to avoid splippage and reduce fees

- Short position opened at higher price than spot buy position

- Both orders 100% filled

- Sustainable high funging fee

- Both positions closed by limit orders to avoid splippage and reduce fees

- Short position closed at lower price than spot sell position

- Both orders 100% filled

8. Tips and tricks

- You can do several things with your long position to earn yield on it instead of just keeping the tokens. For example:

- Lend it on lending protocols/CEXes

- Liquid stake it (simple staking usually takes time to unstake, so is not so convinient)

- Leverage liquid stake it by looping on lending protocols

- You can use chains and protocols that announced an airdrop oportunity to raise your future airdrop allocation. For example you can use Phantom wallet, open your spot buy position on Jupiter and perp short on Drift and provide the tokens from spot position on Rain.fi. In result you expose yourself to several airdrops:

- Phantom wallet - not announced but expected

- Jupiter - ongoing yearly airdrop campaigns

- Drift - ongoing airdrop opportunity

- Rain.fi - expected airdrop, points system implemented

The point is not to count on the airdrop. Just do your job and get a nice surprise from time to time...

- Use market orders only in case of high liquid spot market/high OI perp market. Otherwise 2x fees + 2x slippage might cost more than the funding fee collected if it flips too fast.

- You can use Coinglass funding rate arbitrage to figure out current opportunities but unfortunately it includes almost only CEXes. I highly recommend to check the perp DEXes in according ecosystem to compare the funding fees before making any move.

Disclaimer: The information provided is for educational purposes only and should not be considered financial advice. I am not a financial advisor. Investing in cryptocurrencies involves risk, and you should always do your own research before making any investment decisions